Smarter Financial Research Starts Here

Ravino Research Hub: AI powered Research Assistant for Institutional Investors

Problem We Solve

Institutional Research is Drowning in Data, Not Insight

Modern equity research requires navigating an overwhelming volume of fragmented data in search for Alpha generation. Traditional tools are too rigid. Generic AI isn’t tuned for nuance, trust, or proprietary workflows.

Problem We Solve

Institutional Research is Drowning in Data, Not Insight

Modern equity research requires navigating an overwhelming volume of fragmented data in search for Alpha generation. Traditional tools are too rigid. Generic AI isn’t tuned for nuance, trust, or proprietary workflows.

Problem We Solve

Institutional Research is Drowning in Data, Not Insight

Modern equity research requires navigating an overwhelming volume of fragmented data in search for Alpha generation. Traditional tools are too rigid. Generic AI isn’t tuned for nuance, trust, or proprietary workflows.

Key Challenges

Information overload

Siloed data across sources

Internal research is underutilized

Limited time to synthesize, reason and compare

Generic AI is inaccurate, can’t access internal data or explain answers

Our Solution

A Research Copilot That Cuts Through the Noise

A Research Copilot That Cuts Through the Noise

A Research Copilot That Cuts Through the Noise

Ravino Research Hub is a vertical AI assistant built for investment professionals in Finance. It surfaces what matters to you across financials, documents, and the web — and works with your internal data.

Ravino’s Agentic workflows combine natural language analytics, semantic search and web search across structured and unstructured sources of information.

Ravino Research Hub is a vertical AI assistant built for investment professionals in Finance. It surfaces what matters to you across financials, documents, and the web — and works with your internal data.

Ravino’s Agentic workflows combine natural language analytics, semantic search and web search across structured and unstructured sources of information.

Cross-source intelligence — all in one place

Synthesizes insights across: Transcripts and filings, Financials and live web

Cross-source intelligence — all in one place

Synthesizes insights across: Transcripts and filings, Financials and live web

Cross-source intelligence — all in one place

Synthesizes insights across: Transcripts and filings, Financials and live web

Amplifies proprietary insights

Connects securely to internal documents, models and databases to surface insights

Amplifies proprietary insights

Connects securely to internal documents, models and databases to surface insights

Amplifies proprietary insights

Connects securely to internal documents, models and databases to surface insights

Agentic, conversational assistant

Plans, searches and reasons to answer to complex questions. Get structured, visual, or narrative outputs

Agentic, conversational assistant

Plans, searches and reasons to answer to complex questions. Get structured, visual, or narrative outputs

Agentic, conversational assistant

Plans, searches and reasons to answer to complex questions. Get structured, visual, or narrative outputs

Enterprise-grade security

Deploy behind your firewall with full data governance

Enterprise-grade security

Deploy behind your firewall with full data governance

Enterprise-grade security

Deploy behind your firewall with full data governance

Key Use Cases

What Ravino Helps You Do

What Ravino Helps You Do

Whether you're screening new ideas or monitoring a portfolio, Ravino acts as your research co-pilot. Ravino broadens your portfolio coverage, accelerates decision-making and generates stronger alpha.

Fundamentals Deep Dives

Portfolio Monitoring

Discovery & Diligence

Internal Insights

Fundamentals Deep Dives

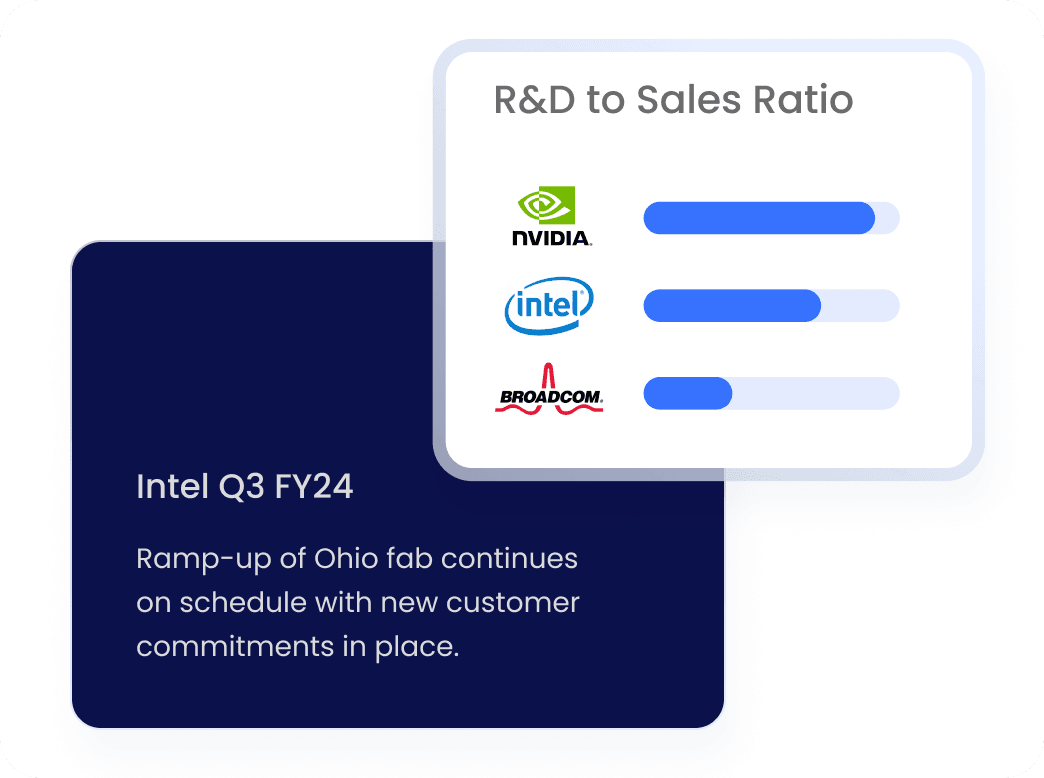

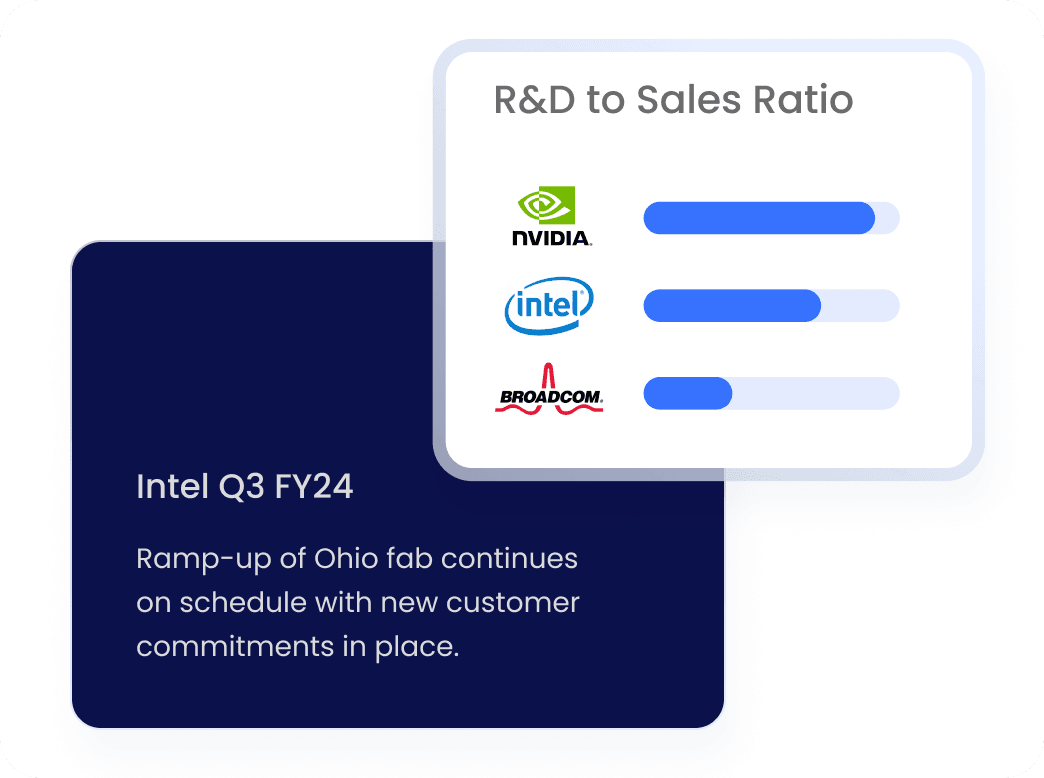

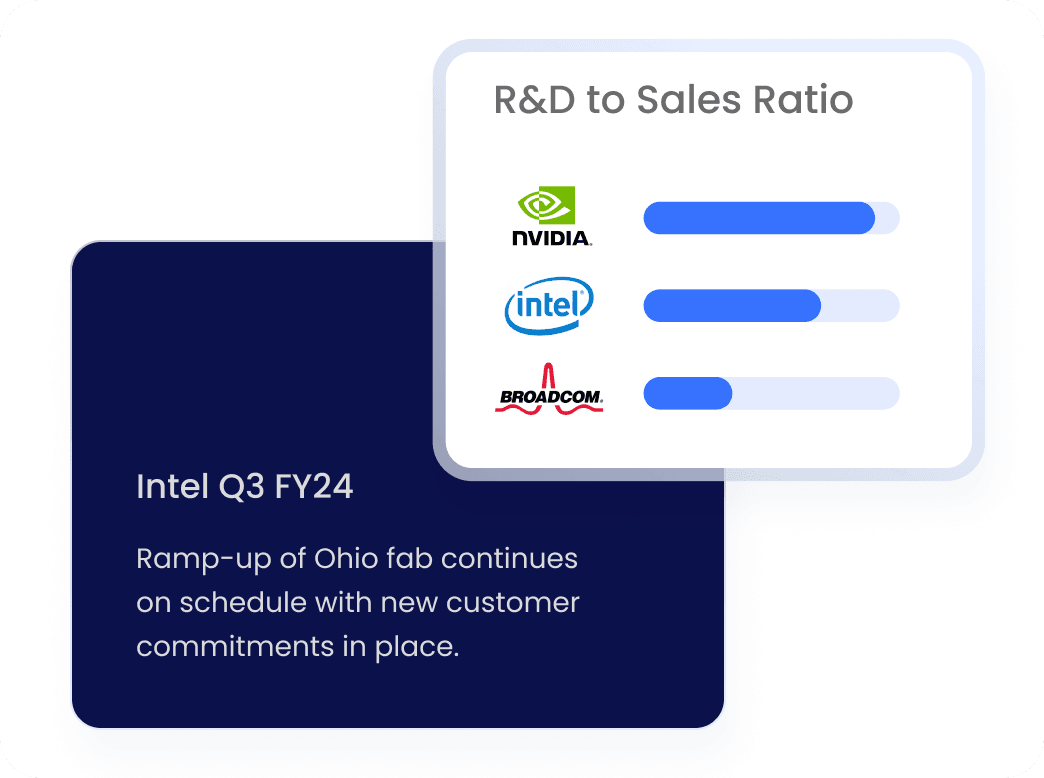

- Compare financial parameters and fundamental assumptions across peers and time periods. - Identify risk factors or forward-looking statements from filings and earnings transcripts. - Extract and summarize commentary related to any signal that impacts valuation. - Generate tables and charts from quarterly filings — instantly

Fundamentals Deep Dives

Portfolio Monitoring

Discovery & Diligence

Internal Insights

Fundamentals Deep Dives

- Compare financial parameters and fundamental assumptions across peers and time periods. - Identify risk factors or forward-looking statements from filings and earnings transcripts. - Extract and summarize commentary related to any signal that impacts valuation. - Generate tables and charts from quarterly filings — instantly

Fundamentals Deep Dives

Portfolio Monitoring

Discovery & Diligence

Internal Insights

Fundamentals Deep Dives

- Compare financial parameters and fundamental assumptions across peers and time periods. - Identify risk factors or forward-looking statements from filings and earnings transcripts. - Extract and summarize commentary related to any signal that impacts valuation. - Generate tables and charts from quarterly filings — instantly

Target Segments

Built for Today’s Investment Research Teams

Powerful Features. Zero Guesswork

Powerful Features. Zero Guesswork

We Serve

Asset Managers

Institutional Research Teams

Hedge Funds

Boutique Investment Advisors

Family Offices

Getting Started Is Simple

From Demo to Deployment in Weeks — Not Quarters

We get it. Payble simplifies the process of tracking, budgeting, and saving, so you can stress less.

We get it. Payble simplifies the process of tracking, budgeting, and saving, so you can stress less.

We get it. Payble simplifies the process of tracking, budgeting, and saving, so you can stress less.

1. Discovery & Scoping

Identify data sources and use cases

1. Discovery & Scoping

Identify data sources and use cases

1. Discovery & Scoping

Identify data sources and use cases

2. Pilot / POC

Deploy AI assistant on real workflows

2. Pilot / POC

Deploy AI assistant on real workflows

2. Pilot / POC

Deploy AI assistant on real workflows

3. Rollout

Integrate, optimize, and expand

3. Rollout

Integrate, optimize, and expand

3. Rollout

Integrate, optimize, and expand

The Ravino Advantage

Ravino Research Hub transforms how analysts and investment teams move from data overload to decision clarity — faster, smarter, and fully transparent.